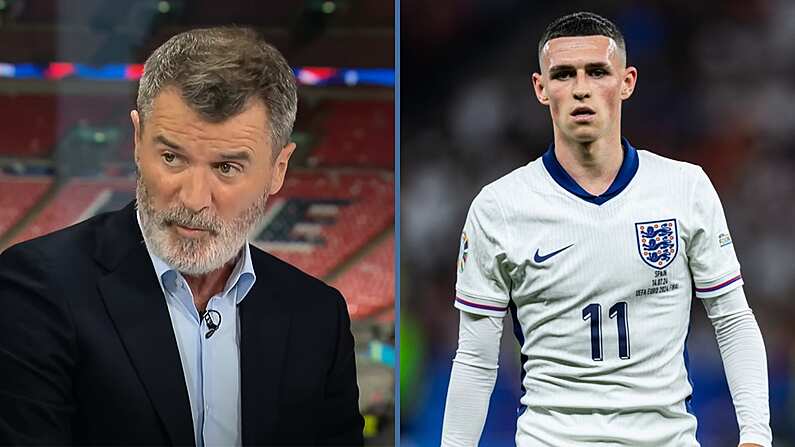

Former Munster and Ireland rugby player Donncha O'Callaghan says losing money through investments in Custom House Capital was "a wake-up call" for him.

Last week, four men - John Mulholland, Paul Lavery, John Whyte and Harry Cassidy - were sentenced to between 12 months and seven years in prison for defrauding their clients.

Judge Orla Crowe said investors "were systematically deceived in a sophisticated operation which went on for over two years by people who owed them fiduciary duties."

Many of those clients, like O'Callaghan, were simply saving for their retirement.

"I think it's a real cop-out to say I took bad advice," the 44-year-old O'Callaghan, who won 94 caps for Ireland and two Heineken Cups with Munster, told the Insights with Seán O'Rourke podcast.

"I was ill-informed - that lies with me. I took people's experience in certain areas as if 'Yeah, that's good enough for me because he knows it inside out' whereas I've learned you have to know it inside out.

"I look at that whole scenario and I look at myself at that time, and I’ll be honest with you, I'm more disappointed with myself than anything else.

"I should have done more work. I should have been more self-aware - of not only the type of business and the type of funds I was putting my money into - but also the character of the people involved in it.

"For me, it was a massive lesson, a wake-up call. I personally blame no one bar myself. I'll be honest with you, at the time, we were nearly going off the dressing room vibe. These lads were putting it in, and I was putting my money where I didn't have a knowledge - that is absolutely something I would never do any more."

24 May 2008; Donncha O'Callaghan, Munster, celebrates at the final whistle Heineken Cup Final, Munster v Toulouse, Millennium Stadium, Cardiff, Wales. Picture credit: Brendan Moran / SPORTSFILE

O'Callaghan continued: "Whatever about being good at your job, you have to be honest and truthful. That was the biggest disappointment for me within it.

"You can understand finances not performing but when you realise some of the stuff that was going on... disappointed is the wrong word. I'll be honest, I was pissed off.

"I was putting my money in there at the prime of my career that could have sustained me if I had been putting it in smarter choices with better people. I know it sounds crazy but we all want to spend more time with our families and money allows us to do that. I'll have to graft away for another while. I don't mind doing that.

"I won't say the amount [I lost], but I was maxing out my pension contribution, and I was putting it all in there every time. Every year I was putting the max I could... over the course of maybe six [years]."

O'Callaghan said he has been partially recompensed but that it's "nowhere near the amount that was put in".

"A hard lesson but vital for me," he added.

"You cannot offload responsibility for stuff like that. I know you need to take expert advice. In a mad way, I had a gut feeling before it, and I wish I'd backed it.

"At the time, the IRFU had a brilliant policy in place where they could incentivise us. Every time we put money into our pension, they would put 10 per cent on top.

"An awful lot of us looked for these smarter ways whereas I wish I had questioned not only the type of funds, [but also] upskilled myself to get educated in them, and in the end character-tested the people involved.

"Whatever about businesses, it's good people that you want to be around, good people that you want to back."